In the iGaming industry, payment solutions need to be tested for both fluidity of use, and security of payment. Whether it’s delivering better UX, minimizing bounce rates, or ensuring transaction security, payment solutions need to do it all. Consequently, testing for such a complex tool is not just a technical necessity; it is the fundamental bedrock upon which player trust is built.

Crowdtesting now stands at the forefront of ensuring the seamless and secure operation of payment systems. Its increasing adoption signifies a strategic shift towards a more effective and cost-efficient approach to testing. The fact is, traditional payment testing often fails to deliver.

In this article, we explore the world of payment systems in iGaming, and why operators are increasingly relying on crowdsourced payment testing to do the heavy lifting.

- iGaming operators look to integrate new payment options

- An iGaming operator client's success with crowdsourced payment testing

- The limitations of traditional payment testing methods

- Embracing the future: crowdsourced payment testing with Testa

- A payment-smooth future for iGaming operators and players

iGaming operators look to integrate new payment options

In 2023, a study from Juniper Research estimated that iGaming fraud is expected to cost operators $7.2 billion in 2023 alone.

It is perhaps no surprise then that iGaming operators have rushed to find payment partners as they look for ways to ensure earnings are not undercut by illicit activities and provide players smooth payment experiences:

- Entain partnered with Paysafe to provide secure real-time payments in the UK.

- Paysafe partnered with blockchain company Ripple to create new ways to transparently process transactions with blockchain technology.

- Payment provider Trustly launched a new identity verification solution for iGaming operators that uses an AI trained on customer profile data to verify player identity.

- iGaming operator Betsson expanded its partnership with payment provider Adyen to integrate payment through Apple Pay and Google Pay into its ecosystem.

These headlines might grab attention, but they also scream a simple truth – iGaming payments are getting trickier, riskier, and more convoluted. With a veritable mix of third-party payment joining the fold, it’s no longer just about flashy announcements and cutting-edge tech; it’s about dealing with the chaos that follows. Thorough and independent testing isn’t just about preventing illicit activities in payment solutions; it’s also about enhancing player satisfaction, especially in the iGaming industry. Without it, operators face increased risks that cost time and money.

To deal with these complex and ever-evolving payment solutions, thorough testing has become a necessary strategic move for operators looking to safeguard their platforms. Crowdtesting services like Testa have emerged as clear winners in this landscape, offering a cost-effective way to thoroughly test payment solutions in a real-world environment. Operators can proactively identify vulnerabilities, address potential exploits, and secure the payment process by working with our expert team.

An iGaming operator client's success with crowdsourced payment testing

With over 50 million customers across 100 markets, our iGaming operator client faced challenges with high withdrawal processing times and a notable number of failed withdrawals. This predicament not only resulted in customer dissatisfaction but also cast a shadow on their reputation as a reliable iGaming operator.

Challenge

Their payment system was facing high rates of failed payments and chargebacks that caused substantial revenue loss. The poor user experience created a pressing need for a comprehensive solution.

Solution

The prominent iGaming operator turned to Testa, a leading provider of crowdsourced testing services. Leveraging Testa’s expansive global network of Testa Qrowdtesters, their payment system was subjected to a comprehensive suite of testing scenarios across diverse devices, browsers, and operating systems in various markets.

Results

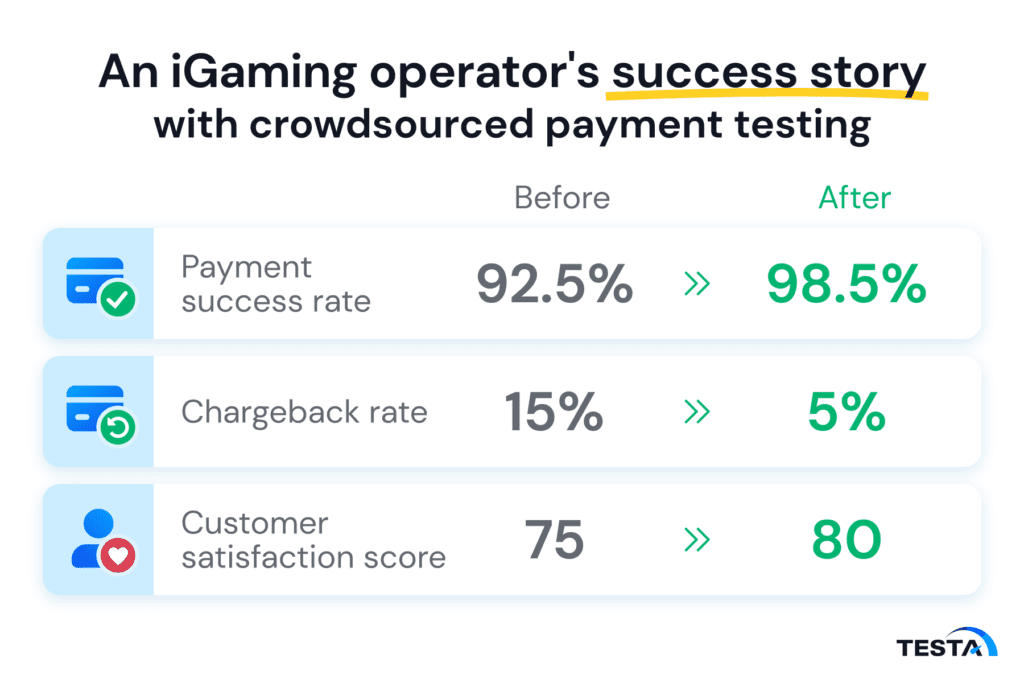

The collaboration between the operator and Testa yielded impressive results across multiple facets.

- Payment system performance:

The success rate of their payment system saw a remarkable upswing, soaring by 6%. - Fraud prevention:

The chargeback rate, a critical metric for fraud prevention, witnessed a substantial decline, plummeting by 10%. - User satisfaction:

The end-users, who bore the brunt of payment-related issues, experienced a significant boost in satisfaction. Their customer satisfaction score rose by 5%. - Agile bug resolution:

The program enabled our client to identify and rectify bugs in their payment system at an accelerated pace, contributing to a more seamless user experience. - User behavior insight:

By tapping into Testa’s diverse tester base, the operator gained valuable insights into how real users interacted with their payment system, enhancing their understanding of user behavior. - Data-driven decision making:

Armed with data collected from crowdsourced testing, The operator was empowered to make informed, data-driven decisions concerning the optimization and enhancement of their payment system.

Overall, the crowdsourced payment testing program conducted by Testa emerged as a resounding success for the operator. The initiative not only addressed the immediate challenges but also propelled our client toward a more robust, secure, and user-friendly payment system.

- Before crowdsourced testing:

- Payment success rate: 92.5%

- Chargeback rate: 15%

- Customer satisfaction score: 75

- After Crowdsourced Testing:

- Payment success rate: 98.5%

- Chargeback rate: 5%

- Customer satisfaction score: 80

The limitations of traditional payment testing methods

Traditional payment testing methods, once deemed reliable, are now revealing their limitations in addressing the dynamic challenges faced by operators. These limitations stem from the inherent inability of traditional methods to faithfully mimic real-world user experiences and identify critical vulnerabilities that lie dormant and ready to wreak havoc on deployment.

- Unreflective of real-world conditions:

Traditional testing methods often fall short in capturing the nuances of real-world scenarios. Mimicking environments in which iGaming payments operate is a daunting task for in-house testing or relying solely on payment solution providers. This shortfall translates into a gap between simulated testing and actual user experiences, leaving crucial vulnerabilities undetected. - Undetected issues from unthorough testing:

The consequences of undetected payment system issues can be severe, ranging from financial fraud to customer dissatisfaction and even regulatory non-compliance. In an industry where trust is paramount, any compromise on payment system reliability poses a threat to the operators’ reputation and the overall integrity of the iGaming ecosystem.

Embracing the future: crowdsourced payment testing with Testa

Against this backdrop of shortfalls, the emergence of crowdtesting service providers like Testa taps into the strengths of real-world testing to offer superior testing results at competitive rates.

Advantages of crowdtesting with Testa:

- Independent and unbiased testing:

Unlike in-house testing or relying solely on payment solution providers, Testa offers an independent and unbiased evaluation of payment systems, ensuring a comprehensive and impartial assessment. - Real-world tests:

Testa’s crowdsourced testing approach brings real-world scenarios to the forefront. Qrowdtesters, drawn from a diverse global pool, engage with the payment systems in ways that closely mirror the actual experiences of end-users. - iGaming expertise:

Testers within the crowd are not just random individuals; they possess familiarity with the intricacies of iGaming. This expertise allows for a more nuanced evaluation of payment systems tailored to the specific demands of the industry. - Global reach:

With a global network of testers, Testa ensures that iGaming operators can validate their payment solutions across different markets, providing a holistic understanding of system performance. - Scalability:

Testa’s crowdsourced testing platform is scalable, catering to the needs of iGaming companies of any size. Whether a startup or an industry giant, the platform adapts to the scale required for thorough testing. - Cost-effectiveness:

Crowdtesting offers a cost-effective alternative to traditional testing methods. By tapping into a vast network of skilled testers on-demand, operators can optimize testing expenses without compromising on quality. - Customer satisfaction:

Thorough testing with Testa contributes to improved payment system performance, directly translating into heightened customer satisfaction. A seamless payment experience fosters trust and loyalty among users. - Regulatory compliance:

Crowdtesting aids in compliance with payment card industry (PCI) standards and other relevant regulations. This ensures that operators meet the necessary regulatory requirements, reducing the risk of non-compliance penalties. - Fraud reduction:

By identifying and addressing vulnerabilities, crowdtesting becomes a proactive defense against potential exploitation by fraudsters. It safeguards against issues like bonus abuse, contributing to a more secure payment environment.

A payment-smooth future for iGaming operators and players

In conclusion, the adoption of crowdtesting marks a pivotal shift in how iGaming operators approach payment system testing. The advantages—ranging from real-world testing and global reach to cost-effectiveness and enhanced customer satisfaction—underscore the significance of this innovative approach.

As the iGaming industry continues to navigate the intricate landscape of payments, crowdtesting with providers like Testa emerges not just as a solution but as an essential component for building a robust, secure, and user-friendly iGaming payment infrastructure.

Contact us today to secure your iGaming payment infrastructure with crowdsourced testing. You can also find us on LinkedIn to read about industry best practices or success stories of operators that have embraced the future of crowdtesting.